Is the "Santa Claus" rally upon us? Discovered back in 1972 by Yale Hirsch, the Santa Claus Rally is known in the market as a 7-day trading period that starts on Christmas Eve and ends in early January. Statistical data show the S&P 500 rallying on an average of 76% of the time. So, are we expecting to see a Santa Claus rally for this upcoming week?

Big Picture

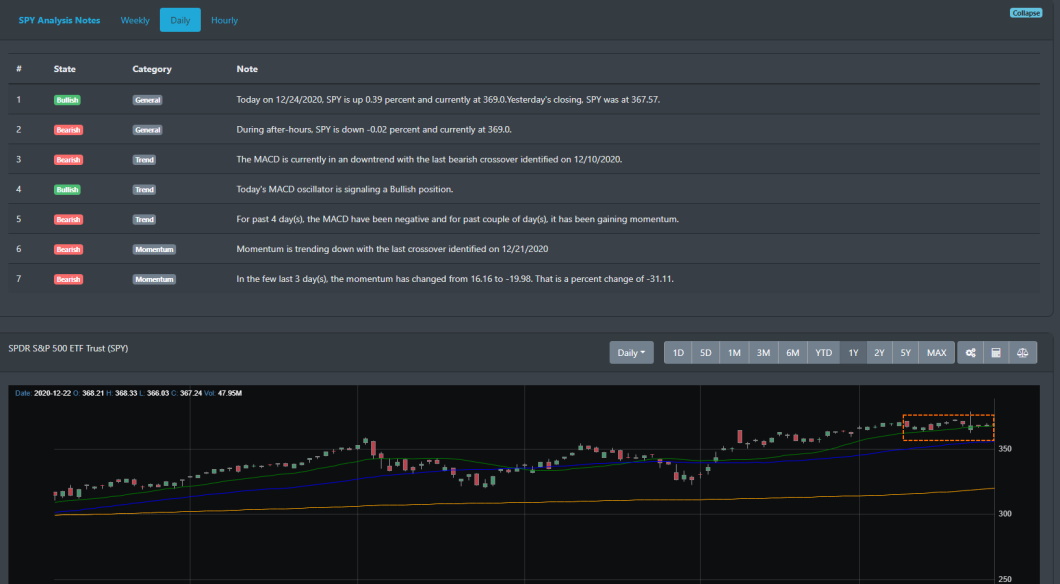

Right now, there is a good indication that the Santa Claus rally could be upon us. Looking at the chart below, the S&P 500 has been in a holding pattern since breaking to the 3,700 support line on 12/17. This consolidation has allowed for some of the short-term overbought signals to subside.

Market Breadth

For the past week, we can see that the market has been showing signs of a topping off. Concerns over a coronavirus mutation and uncertainty with the stimulus package had the markets on edge. However, on Friday, stocks closed higher going into the holidays. This was partly due to the good news regarding BR exit deal.

As noted in our prior blogs, the number of stocks participating in the current rally is unprecedented. Our secondary data indicators are still showing over 70% of stocks trading above their 200-DMA.

Market Sentiment

Exuberance in the market was pretty clear in November. After a very volatile October month, investors turned their hopes to the passing of more stimulus package and good news on the vaccine front.

This ingredient helped propelled the market in November to all-time highs. With FOMO in high gear, markets pushed into new highs until recently. And as you can see below, when BullGap's market sentiment typically reaches above 60 or more, market sentiment usually reverses course. We can see that happening now as the markets are working off overbought conditions.

Market Readings

This has been quite a volatile week for the market. There is some short-selling pressure but as of yet nothing that indicates a reversal.

SPY has been consolidating for a few weeks. QQQ is also in this consolidation pattern. IWM has been in a solid rally since October but as of this week there has been some volatility and MACD sell signal has been triggered. That said, there is no heavy selling pressure and it looks like the market has just been "resting" on its recent highs.

Concluding

As noted last week, BullGap's Momentum Market Timer issued a sell signal recently. This coincides with how we are seeing the market today with lots of consolidation in the past couple of weeks. However, with markets working off overbought conditions, it could mean that we see a Santa Claus rally into the early week of January. Markets have been pushing higher mainly on the notion that a stimulus deal will get passed and recent good news regarding the rollout of the coronavirus vaccines.