Earnings are coming in strong this week with Q121 S&P 500 EPS jumping over 400 bps. Interestingly enough, the PE ratio is currently sitting around 22.7x. It is currently lower than where it was at during year-end 2020 (23.6x) - all the while the S&P 500 is up more than 10% YTD 2021. Also, let's take a look at the US 10-year yield. At the end of last year, it crept up from .80% to a high of 1.75% in March 2021. Now, it is sitting at 1.55%. With the opening of the economy and the rise in the 10-year Treasury note, there were many news pundits and market analysts throwing out doomsday scenarios that inflation would bring down the markets.

You would think that with such strong economic data and rising inflation, the markets would start correcting as many pundits would say. Well, that is not been the case. You probably also have read for the past 2 months that the market is in a bubble and the S&P 500 is highly extended and overbought. Well, the S&P 500 just added 3 new highs this week. The Dow 30 moved into the 34K territory where it set a new high for the 21st time this year. Anyone who hedged this rally has probably lost more than their pride.

Big Picture

The S&P 500 ripped through 4000 like there was no tomorrow. DIJA also went through 34000 without any hesitation. And over the past couple of weeks, the rotational trade is moving from value to growth. Nasdaq has rallied sharply over the past month. Only small caps, emerging markets, and the Russell 2000 have traded in a range.

You can below how the S&P 500 ripped through the 4000 trend line (blue dash) and is now encroaching on the resistance line (red dash). If it pushes through, there is a high likelihood we will be seeing it push to the 4300 range.

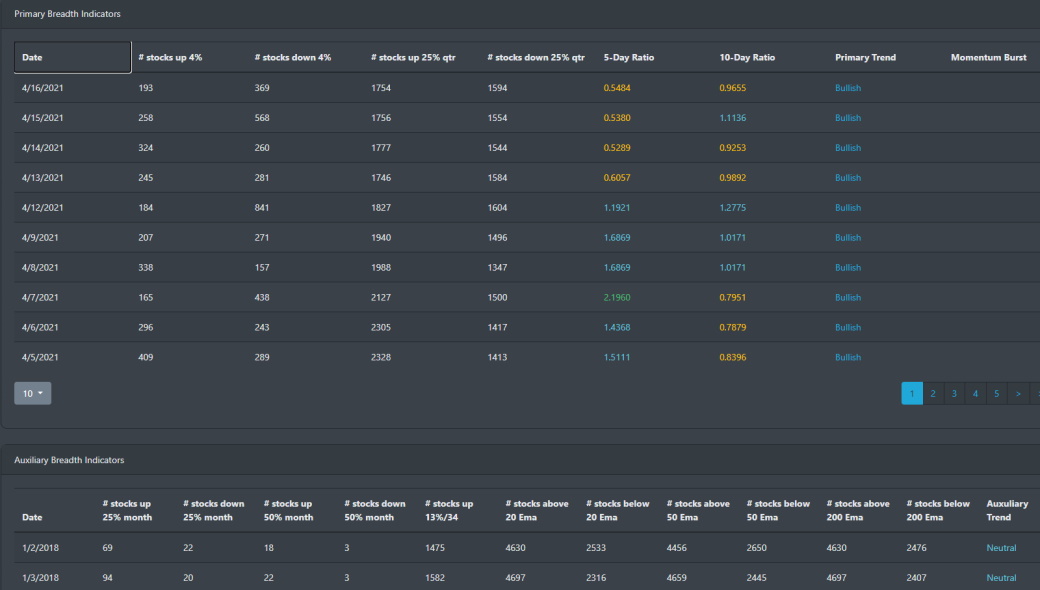

Market Breadth Chart

There is something interesting that is happening this week. Markets breadth was pushing strong in the first couple of days out of this week. It took a pause and now is trying to re-establish itself. The S&P 500 has been rallying higher but the movement in the breadth is foretelling of sideways action. This week will tell more as to how things play out.

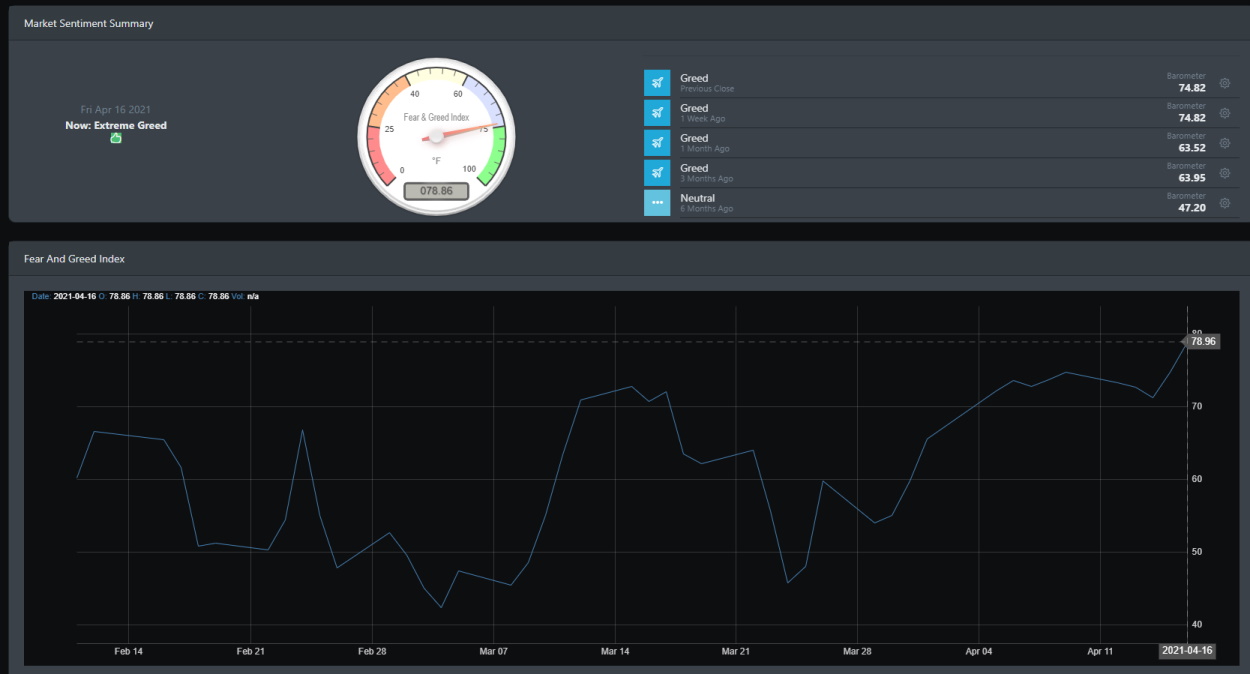

Market Sentiment

As we stated last week, market participants are quite exuberant. Last week, our market sentiment index was sitting at a yearly high of 74.82. The index ended this week with 78.86 which is clearly in the Extreme Greed phase.

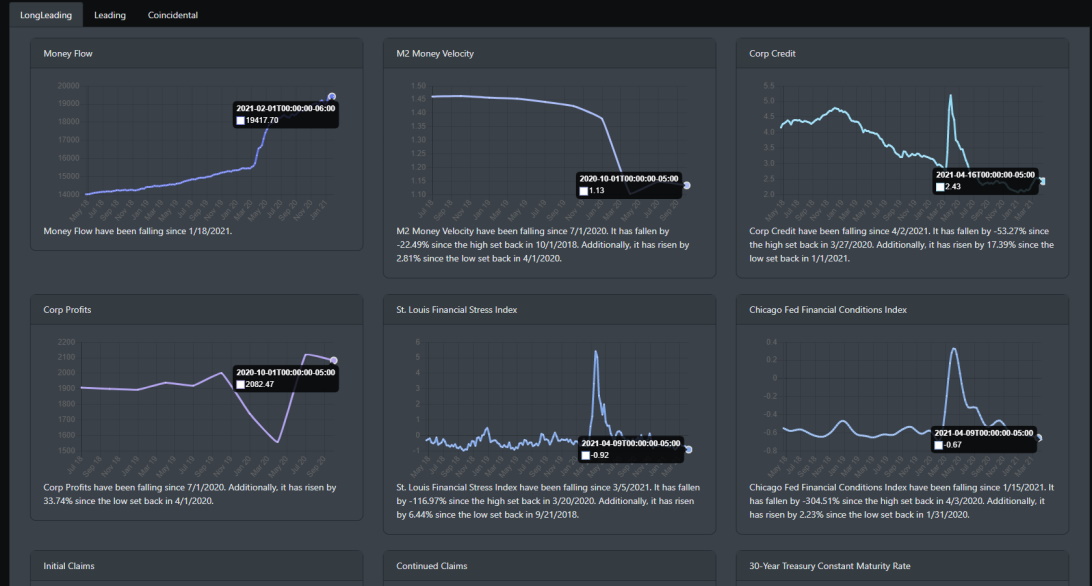

Economic Outlook

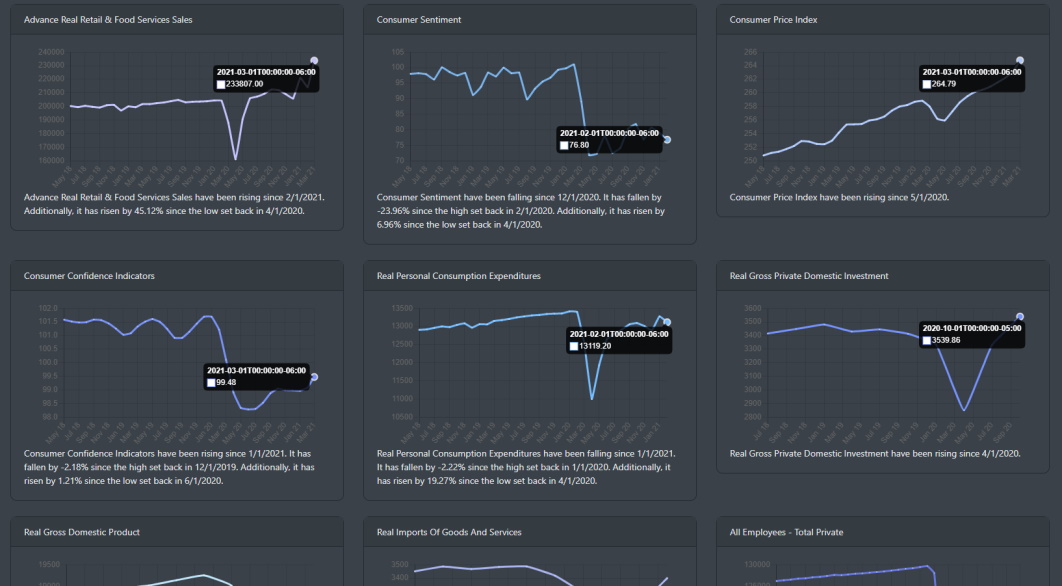

With earnings starting off on the right foot, let's review some of the macroeconomic data. From some of the long leading indicators below, it is still clear from the Money flow data that there is ample liquidity in the market. Corporate credit is still at an all-time low and the financial stress index represented by both St Louis and Chicago indexes are showing green conditions. Corporate profits are above pre-pandemic levels.

Retail sales rose 9.8% in March and this can be seen in the Advance real retail and food services sales below. On March 30th, the consumer confidence index racked up +19 points and is moving in an uptrend.

Market Outlook

The top-performing sectors for this week have been large caps and mid-caps. Small and micro caps were down and are most likely due to the fact that it has been Rallying for the past 6 months. It looks to be in a consolidation phase. Large caps could be the next rotational trade coming up.

IWM

After breaking out in November and rallying past the new year, the Russell 2000 broke the trend in mid-March. On 4/7, it fell through the average trend line (blue dash) and is just hovering above its 50 DMA.

DIA

The Dow broke through support in early April and has since been in an uptrend.

QQQ

Large caps have been testing the support line (yellow dash) for the latter half of the week.

Concluding

Markets are pushing higher while the economic data in March and April are showing a strong economic opening. Many of the new data are also pushing above pre-pandemic levels. The bulls are in control as they have been for most of the past decade. The markets have dismissed the news regarding increasing inflation and market bubbles.