With the holiday season upon us, investors have a mound of worry to digest for their holiday plate. The surging covid cases, Fed discussing interest rate hikes, inflation, etc has been all the talk for most of the year. And many of those negative headlines pointed to a bearish reason as to why the market would sink. However, as we close this week off, the S&P 500 marched onward to break a new high at 4725. In fact, most major indices are near their all-time highs.

Big Picture

For most of December, markets have been quite volatile. Looking at the chart below, it is clear markets have been consolidating since hitting highs back in late November. The December low of 4504 (set in 12/2) started a rally that attempted to push higher. That rally failed and saw a drop to support on 12/20. This week, the bulls gave the bears a strong push to end the week with the S&P 500 closing at a record high. Resistance is now at the 4750 to 4780 region and if the bulls can push upward, it will set up next week for a Santa Rally. If not, we are looking at another drop down to the 4400 to 4500 region.

Market Breadth

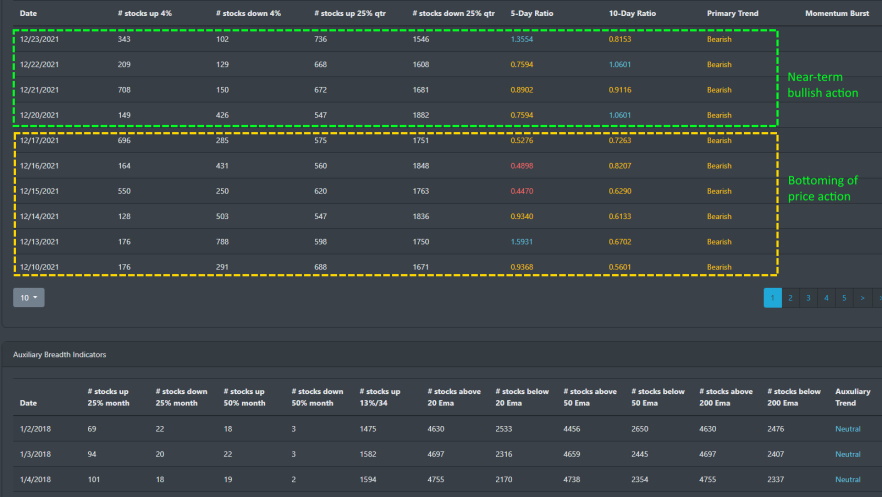

Market breadth has been waning for most of November and into December. While markets were pushing higher in November, market breadth was slowly showing bearish signals. The table below shows the most recent market breadth action for December. Breadth data has been bearish for most of December. However, this week alone should give the bulls some advantage. There is a near-term bullish action that triggered this week and could go be the start of a strong move out of this consolidation period we are seeing in the market.

Market Sentiment

Over the past couple of months, we have been seeing market breadth deteriorating. While market sentiment has been quite bullish over an extended period during the month of November, market internals was showing weakness. Market sentiment started in early November but markets were still pushing higher. We outline this bearish divergence in our prior blogs. Market sentiment for December has been mostly in fear but there is potential now with the last reading that market sentiment could be turning. This same pattern played itself out in September and now market sentiment just hit over 40 and caused a rally to kick off into November. We potentially could be seeing an uptick in sentiment that may kick start the Santa rally.

Economic Outlook

Economic data has been coming in strong to close out the year. According to the BEA 3Q21 GDP report, real GDP has increased at an annual rate of 2.3 percent. There are estimates that the 4Q21 will exceed Q3. Additionally, Home sales saw an uptick of +1.9% for November. The labor market is improving but still nowhere near what it was prior to COVID. The biggest concern in the economy right now is inflation. Currently, inflation is outpacing wage gains by more than 1%.

Market Outlook

This week, all major indices pushed higher off key support levels. Both SPY and DIA are encroaching on all-time highs. QQQ this week pushed above its 50 DMA and IWM is right above its 50 DMA and 200 EMA. Markets have clearly rebounded this week but it appears for most of December markets have been in a consolidation pattern at near all-time highs.

SPY

Since November's high, SPY has been consolidating between 450 to 470. The daily MACD is looking to turn positive and may do so this coming week.

QQQ

Like SPY, QQQ has been in a consolidation pattern since November. After hitting a high in November, QQQ has been sideways for most of December. It has recently pushed above its 50 DMA and the MACD is nearing a buy signal.

IWM

IWM has been consolidating for most of the year. It had a breakout in early November but has since struggled to maintain momentum and is now at key support. It did rally this week to +5.5% but it is still well below its 50 DMA.

Concluding

The official Santa Rally starts tomorrow. With the recent rally this week, are the markets gearing up for a push higher into the 4900+ region? Resistance now is at the 4750 to 4780 region. Is the market can break above this