Markets opened the first day of the 2022 trading year by hitting all-time highs. DJIA pushed higher on consecutive days to start the first week of the 2022 trading week. It was not all gravy as markets started to consolidate and close out the week in the red. With the Fed strongly suggesting that a rate hike will be coming in Q1, there were plenty of news outlets correlating the Fed news to why the markets are topping out. A look back at the last 10 Fed hikes would suggest that the hikes have little or no influence over the markets.

Big Picture

The S&P 500 hit a new high on Monday but quickly followed that up with breaking support near the 4680 regions. The near-term outlook right now looks bearish with the weekly and daily technical readings suggesting more downward pressure is coming this week. If markets cannot hold at the 4680 regions, it is highly likely that we see it drop down to the 4600 to 4650 region. If markets can hold onto support, there is equally a strong chance that it rallies back up to the 4800 regions.

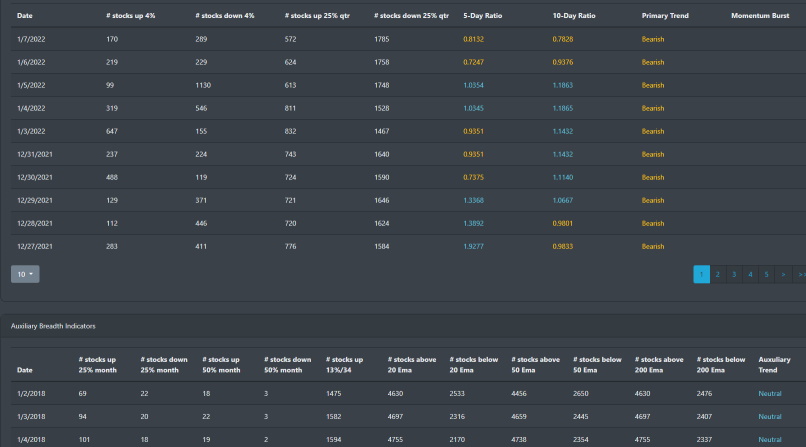

Market Breadth

Market breadth has not changed much for the past couple of months. We did discuss in our last blog that we expected a Santa Rally as near-term bullishness was in play. That did come true as markets did push higher to close out the year. It has since started consolidating this week. There is a potential near-term rally that is being suggested in the 5 to 10-day ratio. On Friday, those 2 ratios crossed to the near-term bullish side. It is too early to determine if this will help propel markets back up to the 4800 region.

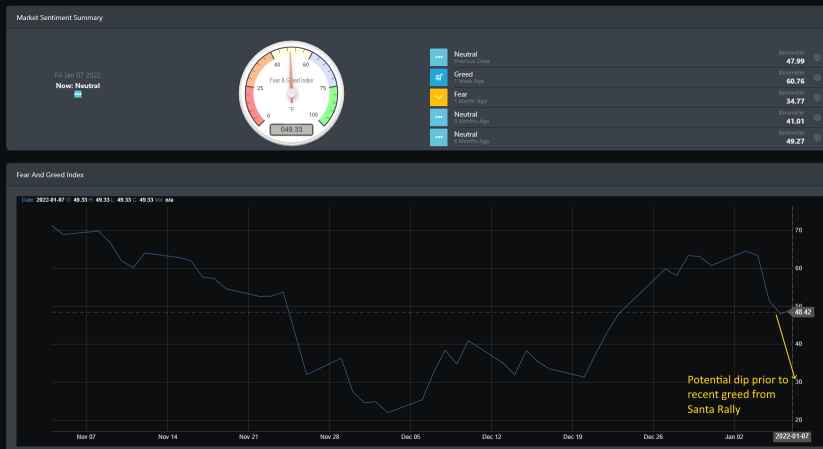

Market Sentiment

There was indeed a strong Santa rally to close out 2021. That week saw BullGap's market sentiment hit a high of 60.76 before declining to 49.33. With technicals being bearish on the intermediate and near-term, we expect to see more downward pressure in market sentiment for the early part of the coming week.

Economic Outlook

The labor market has had 2 straight months of weak hiring data. November's payroll report was well under estimate and December's job reports underperformed by almost 50%. The estimate was near 400,000 for nonfarm payrolls. It came in at roughly ~199K.

While the labor force participation rate remain unchanged, the employment-population ratio increased by 2%.

Market Outlook

The trend is your friend and right now the longer-term bullish trend is still intact. SPY is pushing higher, QQQ and IWM are consolidating after hitting highs and DIA has moved back to its 20 MA support. Let's look at the charts on the weekly timeframe.

SPY

The weekly timeframe shows a strong uptrend. However, the weekly near term is quite bearish with the MACD signaling more downward pressure. The yellow dash box outlines the consolidation pattern that is starting to emerge since late October of 2021.

QQQ

The weekly is also in a strong uptrend. However, just like SPY, QQQ started its consolidation period back in late October. The weekly near-term readings are bearish at the moment.

IWM

IWM has been in consolidation since most of last year. There was a false breakout in late October and IWM has since consolidated back to its mean.

Concluding

There has been quite a bit of volatility to end 2021. That said, the overall trend is still bullish. That said, market breadth is signaling more downard pressure coming. There is potential for a near-term push to the 4800 region with markets testing support.