During the onset of the COVID pandemic in February 2020, markets all over the world took a dramatic nose dive. The crash lasted all but a month and markets started their ascent into all-time highs for the next 2 years. The policy at the time was if the economy started wavering, the Fed and Central Banks would jump in to provide stimulus measures and commit to Quantiative Easing(QE) policy. With low interest rates and low inflation as the backdrop, there was ample amount of money to flow into the financial markets. This concotion of policies helped propel the market. Now, with inflation at over 9%, war in Europe, Feds changing policy of raising rates to slow the economy, markets are now trended into bearish territory. Rallies during the first half of 2022, have been short and any technical bounce off key support has been met with their near upper level resistance.

Big Picture

It has been another volatile week for the financial markets. After starting a rally to start the month of July, the S&P 500 has found it hard to push through its near-term resistance at 3915. The recent bounce though suggest that markets are set to retest the 3915 region again this coming week. Rather than drop back down to support, markets held and consolidated. If markets can push through above 3915, there is a good probability that it will make an attempt to move toward the 4088 region.

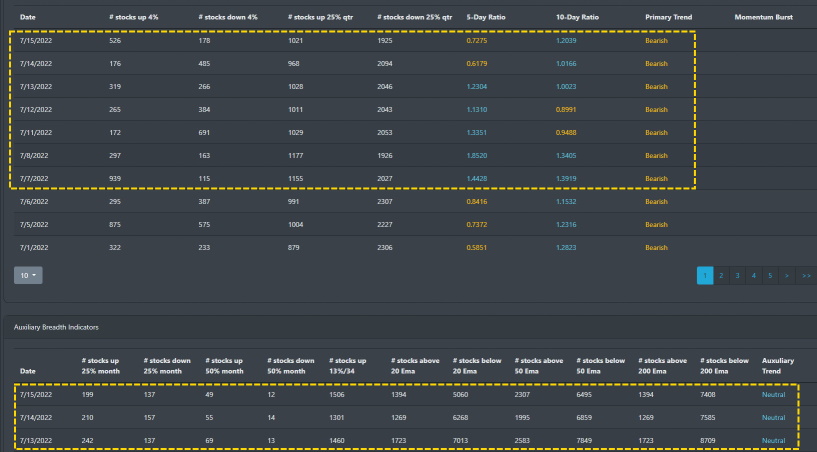

Market Breadth

There is not much to add to the current state of the overall market breadth. As stated before in prior postings, market breadth has been quite bearish. Though there are some short-term bullish trends, the overall market has 80% of trading stocks in bearish territory. The current yellow outline below shows where markets have been in July. We see some signs of a starting rally (blue text color) followed by the bullish trend fading and moving back to a more netural reading. This is typical of a market that currently is volatile and has no direction.

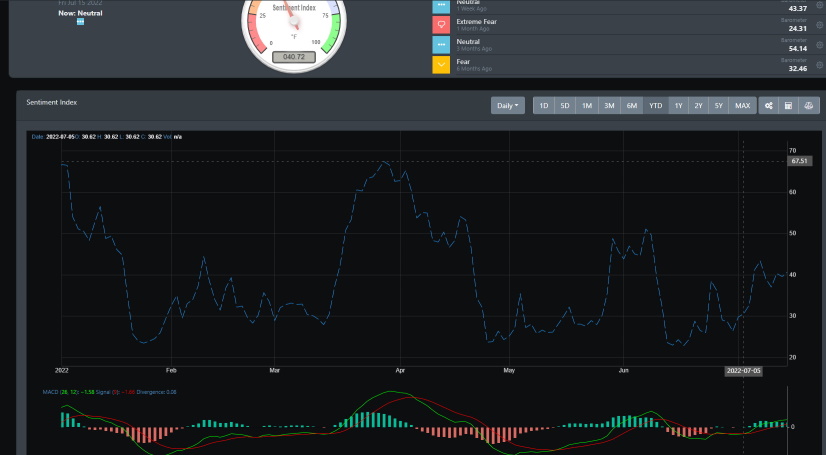

Market Sentiment

Market sentiment currently has a reading of 40.72 which is a neutral reading for BullGap's sentiment index. Since July, sentiment reading has moved from extreme fear to a neutral stance. With sentiment rising, the MACD turned bullish and has held near the 38 to 40 basis reading.

Market Outlook

The current backdrop has certainly limited the rallies in 2022. In our prior blog, we mentioned that we are expecting a rally to start underway. From a technical standpoint, the rally still looks to be starting. Rather than look at the intraday or daily charts, let's take review the weekly chart as it provides a bigger picture view of the technical landscape. If you recall, bigger time frames provide a broader perspective on market direction.

SPY

Looking at the weekly timeframe, we can see on 1/3/2022 that a Monthly sell was triggered for SPY. It was then immediately followed by a Weekly sell signal on 1/10/2022. This combination of bearish signals indicated that markets were ready for a bearish downtrend. With those two signals in place, SPY dropped down to 20% and now has a look of a bottom. There is potential now for the weekly MACD to turn bullish which would help start pushing SPY higher.

QQQ

QQQ follows a similar pattern to that of SPY. On 1/3/2022, both the Monthly and Weekly sell signals triggered indicating a change in overall market direction. QQQ also plunged below 20%. However, QQQ now has a look of turning quite bullish. With a weekly buy signal that triggered on 7/5/2022 and the weekly MACD looking to cross over to the bullish side, there could be a strong indication that QQQ could push higher in the coming weeks or months.

IWM

Small-caps have always been a strong leading indicator for the U.S. financial markets. It spearheaded the rally that followed the 2020 pandemic. IWM's monthly sell signal was triggered on 11/1/2021. The weekly sell signal triggered on 11/22/2021 and IWM has since been in a downtrend. Now, with a weekly buy signal that was triggered on 7/5/2022 and the weekly MACD ready to cross over, it looks like IWM could be signaling a change to the overall market to the upside.

Concluding

Are markets gearing for a strong rally for the latter half of 2022? Possibly but there is still a lot of uncertainty with the global scene (war in Europe), and worries at home with inflation and recession. From a technical perspective, all major indices are near a strong buy signal. With technicals being in highly oversold territory and larger time frame signals poised for a push to the upside, there is a potential for a change in market direction for the bulls. In the near term, markets are looking to challenge the near-term resistance at the 3915 region. For SPY, that resistance line is at the 389 area. If they can consolidate and push upward, there is a good chance that the weekly signals will start moving bullish as well.