A couple of weeks ago we mentioned that the markets were set up for a move lower. Additionally, we suspected that the move down would be anywhere between 200 to 300 points from the last all-time high of 4545.85 made back on 9/2/21. That dropped was fully realized this week when the S&P 500 dipped to a low of 4305.91 (~240 point drop).

The bears were in full force for the earlier part of this week except for the recent pullback only amounts to a 4% drop. Markets did dip below their 50 DMA but they were able to close out the trading week sitting right at the 50 DMA support line.

Big Picture

Markets tumbled earlier this week to round out a bottom near the 4300 support line. You can see this clearly below by looking at BullGap's generated support and resistance lines for the S&P 500. On the intraday, there were several technical signals flashing a bottoming as most technicals were in oversold territory. Having found support, market participants started a counter-rally that now has the market closed right above its 50 DMA.

Market Breadth

Market breadth internals is currently bearish on many fronts. Though the 5-day to 10-day ratio shows bearish, it is only by a small fraction of a point. The 25% stocks up quarterly versus stocks down is also a few points in the bearish direction. Stocks above their 200 and 50 EMA have been declining since mid-February this year.

What does that currently say for market strength right now? September has historically been a low performer for the markets and while there is a counter-rally that has occurred, market breadth suggests that there is not a lot of strength behind the recent move to the upside. Such data suggest that the counter-trend may not have a lot of legs to it. This week will be very important for the market as we will see if September will market back or if we expect the counter-rally to continue.

Market Sentiment

On September 20, market sentiment hit a low of 14.05. It also hit this low around mid-may 2021 before pushing higher again. With market sentiment now in "Fear" mode, there is still plenty of euphoria in the market that has a high probability of continuing the current counter-rally.

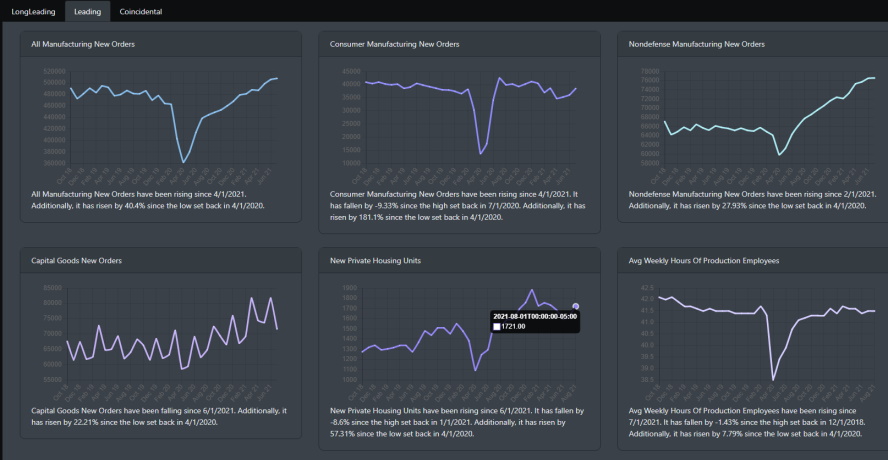

Economic Outlook

The housing market data came in this week positive with new home sales rising to 750K for the month of August. Housing starts spiked to over 1.6 million in August as well. The trend in the strong housing market has been driven primarily by low mortgage rates and the shift to a more suburban lifestyle.

Feds this week discussed their future plans for QE tapering to wind down by 3Q22. For weeks, the Fed has been preparing the market for such discussions. In short, the Fed believes the projected growth rate for the economy is still high. Though there are worries of COVID and supply shortages, the Fed believe that if the recovery remains on track, QE tapering will start at some point in the near future.

Market Outlook

Though market participants did not buy the dip at the 50 DMA, they sure did commence a counter-rally that has potential for moving back to all-time highs. By the close of the trading week, markets were able to regain the 50DMA line and are currently ready for test support next week.

SPY

SPY this week hit oversold levels and bottom-out early this week. It then formed a counter-rally where it now sits above its 50DMA. Additionally, if it can hold this support and move up toward resistance, then there is a good chance we see it challenge its previous all-time high.

QQQ

Like SPY, QQQ also hit oversold territory earlier this week. It also responded with a counter-rally that has it above its 50 DMA. There is still more upside to QQQ with technical readings still registering oversold.

IWM

Unlike SPY and QQQ, IWM has been in a consolidation pattern since February where it is trading between $230 and $210. However, it also had a counter-rally where the momentum index indicator below triggered earlier this week.

Concluding

Markets are definitely in a contentious state. With technical signals indicating a buy signal, there is a good chance that the counter-rally continues into next week. However, with market breadth internals reading bearish, there may not be a lot of upside to this rally. It is possible that the counter-rally continues this week and markets dip further again. If the market can hold above the 4430 support line and continue upward, it is possible markets move to challenge their previous all-time highs. However, we would have to see market breadth swing bullish in the very near term. If markets cannot hold the 4430 line, there is a probability that markets dip even further to the next level of support.