It is interesting how one month can change an investor's perspective in the markets. With one of the strongest rallies in over a decade, the rally off the March 2020 lows had everyone coming into 2022 with a bullish attitude. Our market sentiment index had a reading of +65 coming into the new year of 2022. It was short-lived as January saw equity markets perform one of the sharpest sell-off since the March 2020 lows. SPY dropped -10%, QQQ and Russell faltered -15% and -18% respectively. There has been a lot of discussion regarding the inflation worries and now with the war in Ukraine, there are many news outlets suggesting this conflict will bring down the markets further. If the aggression from Russia does truly affect the overall market, one should ask the question of why the financial markets did not even blink when Russia seized the Crimean peninsula back in 2014.

Big Picture

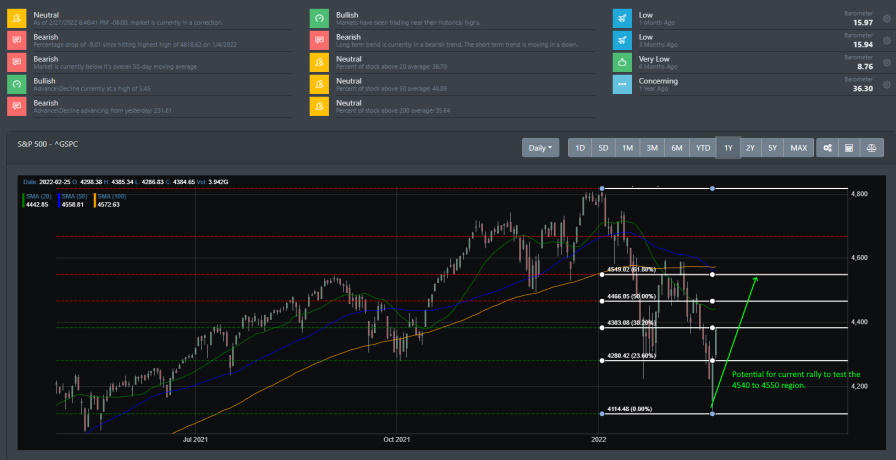

Market indices started this week on a two-week losing streak and market sentiment has been in the fear mode for the better part of this year. Volatility was the name of the game as intraday rallies were engulfed by strong selling for most of Monday and Tuesday. Wednesday broke key support that we discussed during our last blog. When the 4300 regions broke, it opened the door to the market dropping further. Thursday's opening did just that and gapped down to extreme oversold levels. With a quick drop to the 4100 regions, a counter-rally ensued which helped erase the morning losses and helped the S&P 500 close out Friday with +6% in 2 trading sessions.

Market Breadth

We have been discussing for months that market breadth has been deteriorating. In the image below, the red dashed box highlights several key data points within the market breadth readings that were flashing bearish signs. The yellow dashed box highlights where volatility usually occurs. What we see now in the near term is a bullish movement on the stocks up 4% to stocks down 4%. Additionally, Tuesday 2/22/2022 can be viewed as a contrarian reading as stocks below their 200 EMA was at their highest reading.

Market Sentiment

Market sentiment has been in the fear mode for most of the year. Coming into 2022, markets were hitting their stride from the Santa rally, and without much notice, market sentiment start to decline to hit its lows in mid-January. Since then sentiment has been volatile with the index oscillating between the 30 and 40 regions. With the sentiment index being constrained to this region, the market bottom has a high probability that has been set.

Market Outlook

If news truly impacted the overall market trend, no one told Mr. Market as Thursday and Friday were where the bulls decided to come out and push markets higher to where it is now sitting right a resistance (4300 region). Prices are still below their 200 DMA.

SPY

Thursday and Friday were telling as markets gapped down during the morning hours and pushed higher to close out the week. There was no sell-off at the close which indicates market participants are holding onto gains that came just 2 days from hitting support set up back in May 2021.

QQQ

On Thursday prices dropped -22% from their high setback on November 22, 2021. QQQ followed the Thursday morning low by printing a strong rally to close out the week. It is now above 338 support region and the next test of support should be around 350.

IWM

After a strong rally in 2020, IWM has been trading mostly sideways. It did have a false breakout in mid-October of 2021 but has since trended lower. Like SPY, it did have a solid rally to close out the week and there was no sell-off to close out Friday's trading session.

TLT

Back in January, we discussed how TLT was looking to move lower to the 135 region and potentially start a long-term rally from that standpoint. On 2/15, TLT hit a low of 134.98 and has bounced off that low. It will be interesting to see how this pans out in the next couple of weeks.

Concluding

There is plenty of fear in the market at this moment. Investors are now hoping onto defensive stocks as fear engulfs the financial markets. Recalling Warren Buffett's advice to handling market dynamics:

Be fearful when others are greedy, and greedy when others are fearful.

With our market sentiment in fear mode since January and short-term market breadth moving in the bullish direction, there are technical readings now that suggest the bottom has been struck. If the bulls can take this week's late rally into next week, we may be looking at the 4540 region in the coming weeks (or sooner).