It was only recently back in February that we suggested in our prior blogs to buy the dip. There was a fair amount of bearish news coming out of the financial markets but a fair amount of data that we were looking at that suggested the bottom was struck. That week coincided with the start of the Russian-Ukrainian war and markets rallied from their 4100 region to breaking the 4600 region. Markets swung from an oversold to overbought condition in a matter of weeks during the recent rally. This week, every major index fell. The Dow and Russell performed much better than the Nasdaq Composite which dropped -3.4%. Even the crypto such as Bitcoin and Ethereum came in -6% for the week. SPY dropped -2.5% for the week.

Big Picture

Markets clearly rallied from the February 24, 2022 low. It went from deeply oversold to a strong overbought condition in a matter of 4 weeks. Looking at the image below, we can see that our momentum indicator (blue shaded area on the chart), is suggesting a topping with prices currently consolidating near the 4383 region. This clearly looks like the recent rally has stalled and there is potential for more downside pressure coming this week.

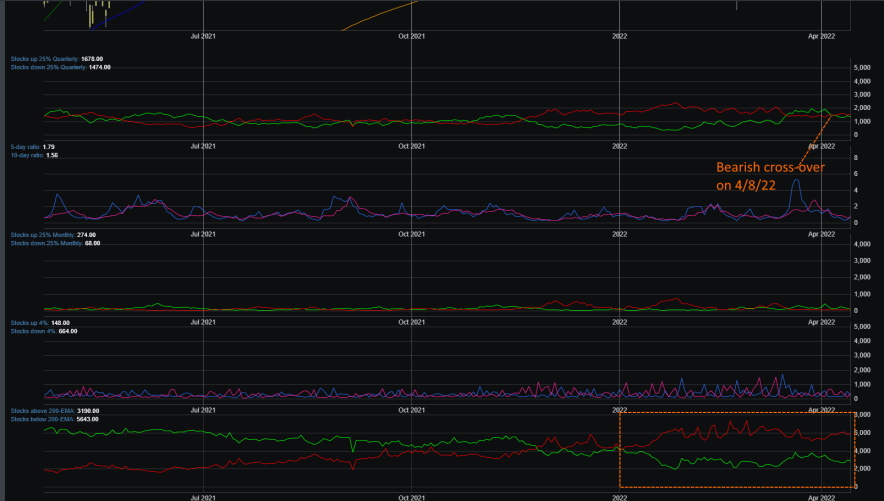

Market Breadth

Market breadth also has been turning over after shortly turning bullish. On 4/8/22, markets crossed over and broke key support near the 4460 region. Though the bearish cross-over has been shallow and prices have been consolidating this week around support, the bears clearly have the advantage now. Market breadth is still soft and the near-term and long-term technical readings are still bearish. The weekly technical signals had a chance to turn positive this week but because of the downside pressure, it has yet to move upward.

Market Sentiment

The bears have certainly reign down in 2022. After a 2 year strong rally from the March 2020 lows, prices have been correcting for the better part of this year. In fact, for the past 6 months, markets have not made much progress in terms of moving higher. Looking at the image below, one could see that we have been mostly in neutral and fear mode for Q1 2022. There was a short-lived rally that occurred recently but that was short-lived and now we are seeing market sentiment move downward. With sentiment still being high for a neutral reading, we expect sentiment to drop further before turning over.

Market Outlook

With markets topping out from earlier this year, a recent rally pushed prices to near\above their 61.8% Fibonacci retracement. It has now reversed and markets are trending lower. However, prices have been trading lower on a more controlled and disciplined sell-off. Let's take a look at TrendFinder and see if we can find an analysis of what to expect from the market in the near term.

SPY

SPY hit an intermediate (weekly) sell signal on 4/11. The last time, the weekly sell signal was triggered was back on 1/10/22. Prices feel shortly after this signal was triggered. Prices currently have consolidated near the 437 support area. If SPY can hold this region, we expect the rally to continue. If not, we suspect that SPY could have a retest of the 420 to 410 region.

QQQ

QQQ had a weekly sell signal back on 1/3/22. It corrected with a drop into the 337 support area. It has since been consolidating and now there is a weekly sell signal that triggered this week on 4/11/22. Like SPY, QQQ is hovering right on the 337 support area. If it cannot hold this support in the coming weeks, it could have a retest of the 320 to 317 region.

IWM

The weekly sell signal for IWM was triggered back on 1/10/22. Prices dropped and have been in a consolidation pattern. It too received a weekly sell signal on 4/11/22. And just like SPY and QQQ, prices have been near support at 197. A break of this support will send it retesting the 187 region.

Concluding

The bears are clearly in control and though the bulls did keep markets from falling further with the recent rally, markets have a look at consolidation. The next few weeks will be volatile in determining the direction of the near-term prices. If the bulls can hold support at 4400 area, then there is a high probability, we see prices continue upward. If prices break below this support, we have prices dropping to their 4280 and potentially 4110 support area.