Market Daily Review: June 11/2020

Last week the market was risk-on and we saw the treasury market sell-off into key levels. At the same time, the equity markets were celebrating a strong jobs report. Only until yesterday, did the Fed provide a statement on their projection of the economy.

These statements all but confirmed the V-shaped recovery will not happen. Even more revealing is that the Feds are projecting a slow recovery path.

It is widely acknowledged that the current market rally is artificially induced by the Fed stimulus and the re-opening of the economy. The disconnect between what is happening on main street and wall street is evident. As of this writing, 40 million people in the US have filed for initial unemployment claims.

And there are reports coming out risks for a second COVID-19 wave hitting the economy are high.

The Rally

Yet, the S&P 500 (SPY) has gained nearly 46% off its bottom in March of this year. In fact, prior to this week, all major indices were moving back up into their earlier year highs.

The Sudden Drop

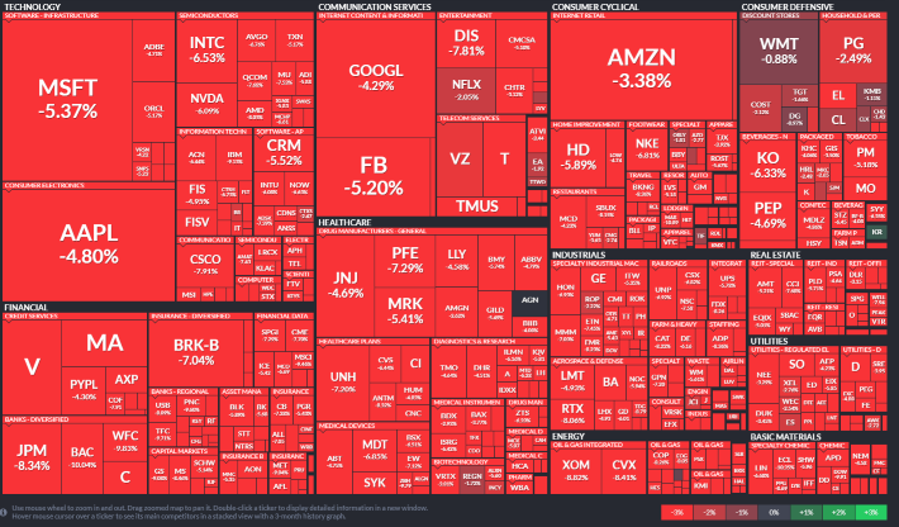

Today, however, things have changed in the past couple of days. Using our app, MogulUp and the Market Daily report, we see that everything is down other than the treasury. SPY and DIJ had an 18% drop from yesterday. Nasdaq QQQ saw a drop of around 12%. TLT our treasury ETF has been making a move toward its previous highs in the last 2 days.

The technical analysis tells us that the weekly trend is nearly still intact for most of the major indices. The MACD and the price percent oscillator is still confirming an uptrend. However, on the daily and hourly, we are seeing the trend change from bullish to bearish. Key indicators of support on the daily and hourly charts have breached into the weekly trendlines for SPY, DIA, and QQQ.

A Sudden Stop or

is the Bear Trap playing out for the retail investors who have been pushing the rally up to early year highs? It is too early to tell if the market is making a strong move down. For now, all major indicies are still in an uptrend. The current rally was long overdue for a correction as technical indicators were reading overbought conditions for the past week. So, today's price drop was dramtic and long overdue from a technical standpoint.